3rd Quarter Treasurer's Report 2023

We are pleased to report that as of the end of the third quarter of 2023, the Club is in a sound financial condition.

Executive Summary

- New Membership Demand is strong.

- Expenses continue to be pressed by cost inflation.

- Campus projects

- Patio Bar & Grill work estimated to commence 2/1/2024

- Tennis Courts refresh plus court #7 work to commence 4/1/2024

- Clubhouse infrastructure and refresh work to commence 10/1/2024

- Golf Course infrastructure and refresh project potential start date spring 2025

- Advantages / opportunity of a Bridge Bond financing

Operation

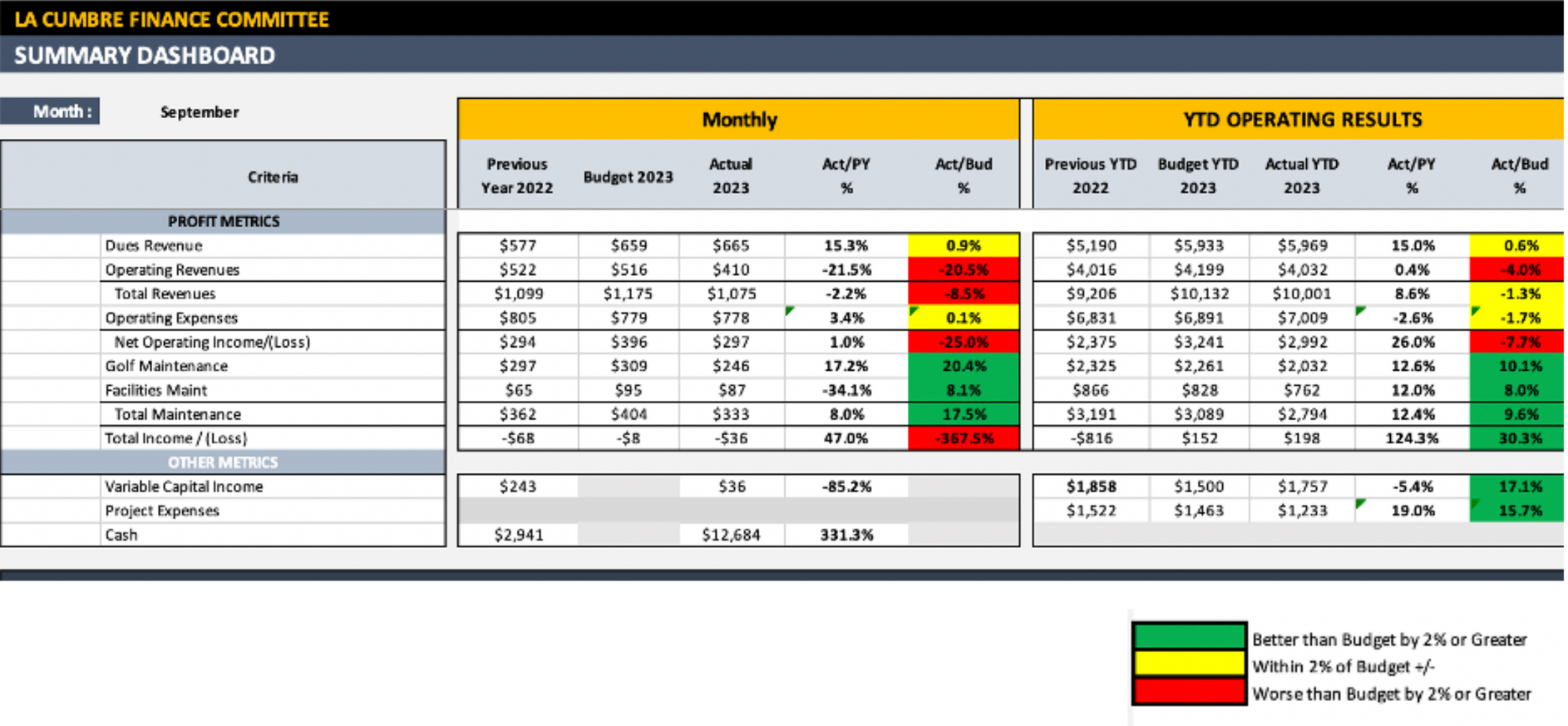

Our membership count continues to be somewhat higher than anticipated, with steady demand across all membership classes. At the end of this quarter, dues income are in line with our budget, but slightly better than last year. The variable capital income earned from transfer fees and initiation fees are also higher than anticipated by 17% at $1.76mm for the first three quarters.

Operating revenues are recovering from the ‘wet winter months’ and ended the third quarter essentially flat to last year at $4.05mm, but slightly lower than budget, which was $4.2mm.

Operating expenses continue to be pressured by cost inflation in every aspect of our operations. We also absorbed several one-time unexpected or unusual expenses. We closed out the third quarter with expenses to date at $7mm compared to a budget of $6.9mm. We currently forecast that over the balance of this year and next, inflation will continue to increase for us at a potentially higher rate than the country average. Whether it is the consequences of higher oil prices, food costs, California wage regulations, and California gas, which is considerably above the national average, the impact is that inflation will likely be higher than normal for longer.

Golf course maintenance and facility maintenance expenses have both been efficiently managed. Both are below budget and better than last year. Many thanks to Wayne and his team for doing so on the golf course.

As we are approximately 12 months from the commencement of the Clubhouse renovation, maintenance will continue to be critically analyzed by Adam before the expenditure is approved.

Overall, we are maintaining a healthy equilibrium between dues and operating income and operating expenses and maintenance and expect to meet the task of operating within this balanced budget. Our current operating income surplus is approximately $200,000, slightly better than the budget of $152,000. This also compares favorably to the same period last year.

As has been mentioned before, local inflation presents a challenge, as do members’ expectations for next year and beyond. We are currently working through the details of the 2024 budget. A central and important theme is to ensure that the club drive value for every dollar that is currently earned or received. However, it is important to be clear that inflation is a significant headwind, and members’ expectation for improved service, food quality, and overall enhancement to the members’ experience.

We are prioritizing initiatives to ensure that the operating budget for next year is right-sized in the face of these challenges.

Campus Project

The work on the four projects continues.

Pre-Assessment funding:

- The PB&G enlarged scope received overwhelming members’ support and is due to commence in four months.

- The Tennis Court refurbishment and addition of ‘Court 7’, is currently on schedule for April 2022.

The Clubhouse cost engineering program is underway and early signs are encouraging in that the gap between actual quotes and estimates being received now is not too far from our original estimates provided nearly two years ago. Once this is completed, I will report separately.

As a reminder, all the projects and the funding were based on a cash flow model, pledging the variable capital income we receive from initiation fees from new members, transfer fees on equity memberships, and the assessment - either paid initially in one payment, over three or five years.

The variable capital income for the first three quarters of 2023 is $1.9mm against a full-year 2023 budget of $2.1mm. From the start of 2023 and the original ending of the golf course project in 2028, the variable capital income is budgeted at $14.3mm.

We carried forward $2.2mm from 2022, so the budget income over the period was $16.5. To date, we have spent $1.2mm across the various projects, which is better than the anticipated spend rate of $2.2mm. This is simply a timing issue, and over the course of the four projects, will normalize.

In addition to the variable capital income over the next few years, we received the 2023 assessment. Many paid in one payment, but some decided to defer payment over the next three or five years. Including the better-than-anticipated interest, we expect to receive approximately $14.4 mm from the assessment.

Golf Course Opportunity

The golf course project is developing nicely. With thoughtful oversight of Todd Eckenrode, Wayne Mills and our Green Committee, our infrastructure plan and preliminary enhanced plan, may provide an opportunity to bring the project forward to 2025. This will enable us to finish the clubhouse in early 2016 and the Golf Course in 2025.

The plan is/was to complete nine holes in 2026, the next nine in 2027, and finally, the short game areas in 2028. There is a budgeted surplus from the first three projects that is allocated to the golf course projects as well as funding from anticipated variable capital income in 2026, 2027, and 2028, which was to further fund the golf course maintenance and enhancement project. Total cost budget of $14.2 million of which $4.2 million was an inflation contingency.

Quotes we have received for construction in 2025 already fully utilize all contingencies and come in at 14.85 mm. The architect and construction teams need us to commit approximately 18 months in advance to book their teams and equipment and place purchase orders for the supplies we will need. For example, Wayne has already bought the grass for the enlarged greens and is maturing it by the 13th hole; this will be utilized no matter which timing we proceed with. We, hopefully, intend to commit to proceeding by the end of this year so that we can start at the end of Quarter 1 2025.

The benefits for proceeding in 2025 are as follows:

- Wayne will be fully engaged and involved bringing invaluable institutional expertise.

- We have secured a known price and can be confident of this estimate.

- The whole project will be completed in 9 to 10 months, finishing by the end of 2025.

- A variety of approximately 9 holes will be available for play during the construction period.

Bridge Bond

We can fund the cost in 2025 by offering a $15 million Bridge Bond to members which:

- Spreads the one-year cost over a period of no more than seven years

- Offers prime rate of interest (currently 8.5%) or 7%, whichever is greater, in January 1, 2025

- Three years interest only and four-year repayment period

- Funding of the bridge bond will be in January 2025

- Funding is 100% voluntary…This funding is independent of dues.

The extra cost of the golf course project ($14.2 to $14.85) is $0.65mm, and the interest paid is made affordable by spreading the repayment over four to seven years. Essentially, we have modelled using 60% of the variable capital income earned over that seven years to repay the principal and interest. This is very conservative, and our hope is we would be in a position to pay the bond holders earlier if that is an advantage to our members, after the minimum three-year-interest only period.

We are currently accepting non-binding commitments from members who are interested in underwriting / investing in the bond, which will give us confidence that we will be able, from a financial aspect, to proceed. As mentioned before, securing the commitments is very important as we must book the construction and architect team by the end of this year.

If you would like more information or would like to discuss the bond, please send me a note, and we will be happy to meet or discuss it on the phone.

This is voluntary... no added personal expense.

Firstly, the bond is simply bringing forward income that we were already relying on to pay for the golf course renovation. No further amount or assessment is being sought on members. If you do not wish to participate in the bond, that is entirely your investment decision, and no funding will be required.

Secondly, no final decision has yet to be made. We are carefully analyzing our options, and by securing the underwriters non-binding commitments we achieve an ability to choose our path forward.

During the first half of 2024, the board will facilitate several members’ meeting and various communications regarding the maintenance and enhancements for the golf course before a members’ vote is necessary for any changes and for the bond.

(By-Law: 8.3f)*

*Authorize such alterations and improvements of the Club’s property as they may deem proper and modify or discontinue any Club facility where such action seems necessary or expedient. [In connection with such alterations and improvements, modifications or discontinuances, the affirmative vote of a majority of the Regular members voting in response to a written request by the Board of Directors shall be required in order for the Board of Directors to (i) incur capital indebtedness of more than $500,000.00, (ii) authorize the expenditure of more than $1,000,000.00, or (iii) reroute existing holes or create new or additional green complexes on the Club’s golf course.]

As our operations and projects mature further, we look forward to sharing more completely. Till then, thank you and we hope you continue to enjoy the beauty and fellowship of La Cumbre.

Please reach out to Adam, Greg or myself if you have any questions, concerns or solutions!!

Respectfully,

Alan Harden