Finance Report March 2023

Dear La Cumbre Members:

As promised in my note last month, I intend to report regularly on the financial aspects of the four projects we are managing.

Before I do so, however, I would like to give Jeff Cowan, our Controller, Elizabeth Stuart, our staff accountant, and Lanita Pattenaude, Director of HR a shout-out for their exceptional teamwork in the first couple of months of this year. They closed out 2022, progressed the Audit, changed banks to American Riviera, set up operating and project accounts, and organized the receipt of the assessment from 820 members, amongst many other things. They have worked extraordinarily hard and efficiently.

As mentioned last month, the funding for all the projects was predicated on the need to use variable capital income from initiation and transfer fees to enhance the campus and not subsidize regular operations.

(dues income + operating income) – (operating expense + maintenance of facilities and sport venues) = 0

(variable capital income) + (assessment) = enhancements to the campus and is fully allocated over the 6 to 7 years plan period.

The variable capital income assumptions were based on our average non-equity and equity memberships turnover. With equity memberships, we were able to look back to 1966 and average the price increase and number of transactions. Since 1966, when the equity membership price first floated, it has compounded at 10.35%, over the last five years at 8.10%, and ten years at 7.98%. It is not a straight line, and we have had years, and at times a few years in a row, where prices have been stagnant or fallen. Nonetheless, the compounding average has been impressive. The number of transactions over the last forty years has been quite volatile, ranging from 9 to 29, producing an average of 16 equity transactions per year.

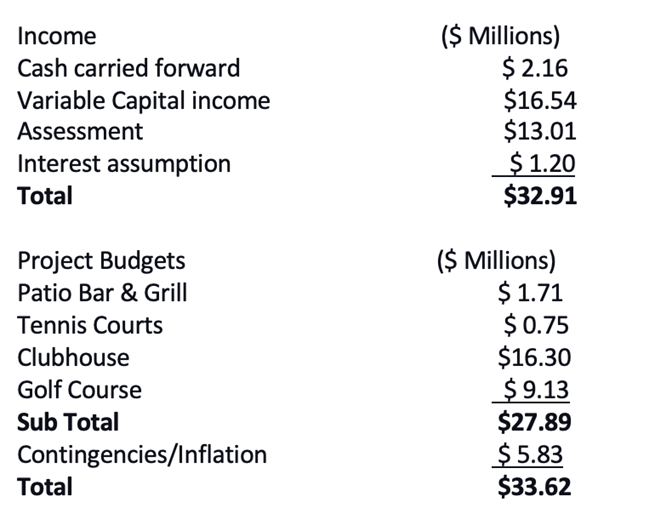

Overall, we conservatively budgeted 6% price growth off a base of $210,000 and 14 transactions yearly. In 2023 we anticipate approximately $2 million in variable capital income; over the project plan period to the end of 2029, we are budgeting $16.54 million.

The assessment was based on the amount needed to fund the four projects minus the excess cash on hand to fund operations plus the anticipated amount of variable capital income over the plan period.

(Project expenditure) – (Cash on hand + variable capital income) = Assessment

This plan was essentially a cash flow funding plan to meet the different project expenditure timelines. It was necessary to make assumptions on the number of members that would select a one-time, annual, or monthly option, including the 7% interest we were going to receive.

“It is tough to make predictions, especially about the future” – Yogi Berra.

The prediction was that 1/3rd of our members would pay up front and 2/3rd defer. Or approximately $4.56 million upfront and $9.91 million deferred, which included approximately $2 million in interest - totaling $14.47 million.

The actual situation is that nearly 2/3rd of members have paid upfront and 1/3rd deferred, or approximately $7.97 million upfront and $5.04 million deferred, which includes only $ 0.56 million of interest - totaling $13.01 million.

The shortfall of $1.46 million will be mostly mitigated by earning interest of approximately $1.2 million on the funds over the plan period. We are grateful for the current rates available and anticipate they will continue to be ‘higher for longer.’ Any delays in permitting or such will allow the interest gap to narrow.

We also carried forward $2.16 million from funds earned last year in Variable Capital Income that was not used to subsidize operations.

Last year, during meetings and various discussions on the project and subsequent assessment prior to the vote, there was much concern among members that the funds raised would, in one way or another, not be allocated as initially intended.

All funds have been placed into a segregated account, the rules of which only allow project-related expenses to be funded. Furthermore, this 'Members Reserve Account’ (MRA) has a detailed Investment policy statement that dictates and directs both the investment policy and the use of the funds. There is also a current investment strategy which the newly formed Investment Committee leads. I am grateful for the contribution of Mike Nicolais, Melissa Gough, and Jason Spievak in serving with me on this committee. Accounts are currently being opened with JP Morgan and Merrill so that CDs, T-Bills, and Money Market funds can be accessed.

Essentially the master capital plan is a cash flow plan to meet the expenditure of the four different projects as they occur over the next six or so years. The budget for the Patio Bar & Grill and Tennis Courts had already been allocated from existing funds. The balance for maintaining and enhancing the Clubhouse and Golf course was approximately $31 million.

The Patio Bar & Grill - $1.84 million

The original budget was $1.59 million, including a larger, more functional kitchen and new furniture. Since beginning the detailed design work and receiving construction quotes, we have been tracking to come in below budget at $1.42 million. However, it became clear that the bar area was too small for members and service staff. Therefore, the decision was made to redesign and expand the bar area. This expansion adds approximately $420,000 to the cost estimate, bringing it to $1.84 million. This bar has become the heart of the club, serving between 98 meals a day in December and 248 a day in July. It also almost breaks even for Food & Beverage, with an annual income of $1.75 million. So, this is a very simple financial cost/benefit analysis, and an enhanced member experience ‘value’ would support the extra funding.

The Tennis Courts and Facility - $0.75 million

The original budget for the tennis courts project was $750,000. The recent meetings and work that has been done with the tennis community suggest that court 7 can be accommodated in this budget.

The Clubhouse - $18.00 million

The current budget remains at $18 million (approx. $8 million maintenance and $10 million enhancement). However, it is still too early to feel comfortable. All the design specifics, various engineers, and consultants still need to finalize all the drawings before we can submit for permits and obtain real and solid quotes from our construction partners. At that point, we will have an estimated cost and start the process of value engineering.

The Golf Course - $13.13 million

The current budget is $13.13 million, which many will remember is made up largely of the irrigation system at nearly $4.85 million and $4.275 million for the work that is underway with Todd Eckenrode.

Included in the above budget numbers, we have built in an amount for unknown contingencies and inflation. The most significant is $4 million for the Golf Course as this project is the last to start (3 or 4 years). The Clubhouse budget includes $1.7 million, and the Patio Bar and Grill has $0.130 million in total, $5.83 million.

Obviously, it is still early for the overall project. As such, we should all recognize that there are several 'income risks.' For example, not achieving financial equilibrium in the operating budget, not achieving the variable capital targets or the interest income target. On the other hand, the 'income opportunities' are exceeding our operating budget, beating the variable capital income targets, or interest rates staying higher for longer.

Regarding 'expenditure risk,' Donald Rumsfeld describes it best; there are Known Knowns (things we are aware of and understand), Known Unknowns (things we are aware of but don't understand), Unknown Knowns (things we understand but are not aware of), and finally Unknown Unknowns (things we are neither aware of nor understand).

As we gain visibility of our income and understand what becomes known or continues to be unknown, I will report back!

Alan Harden,

Treasurer, La Cumbre Country Club